Why Your Best Customers Are Slipping Away (And How Data Can Win Them Back)

Want the uncomfortable truth about acquisition? Well, while you're celebrating this month's 500 new customers, roughly 300 are walking out the door without saying goodbye. Acquiring a new customer costs 5-25x more than keeping an existing one, but so many D2C brands still obsess over acquisition while treating retention as an afterthought.

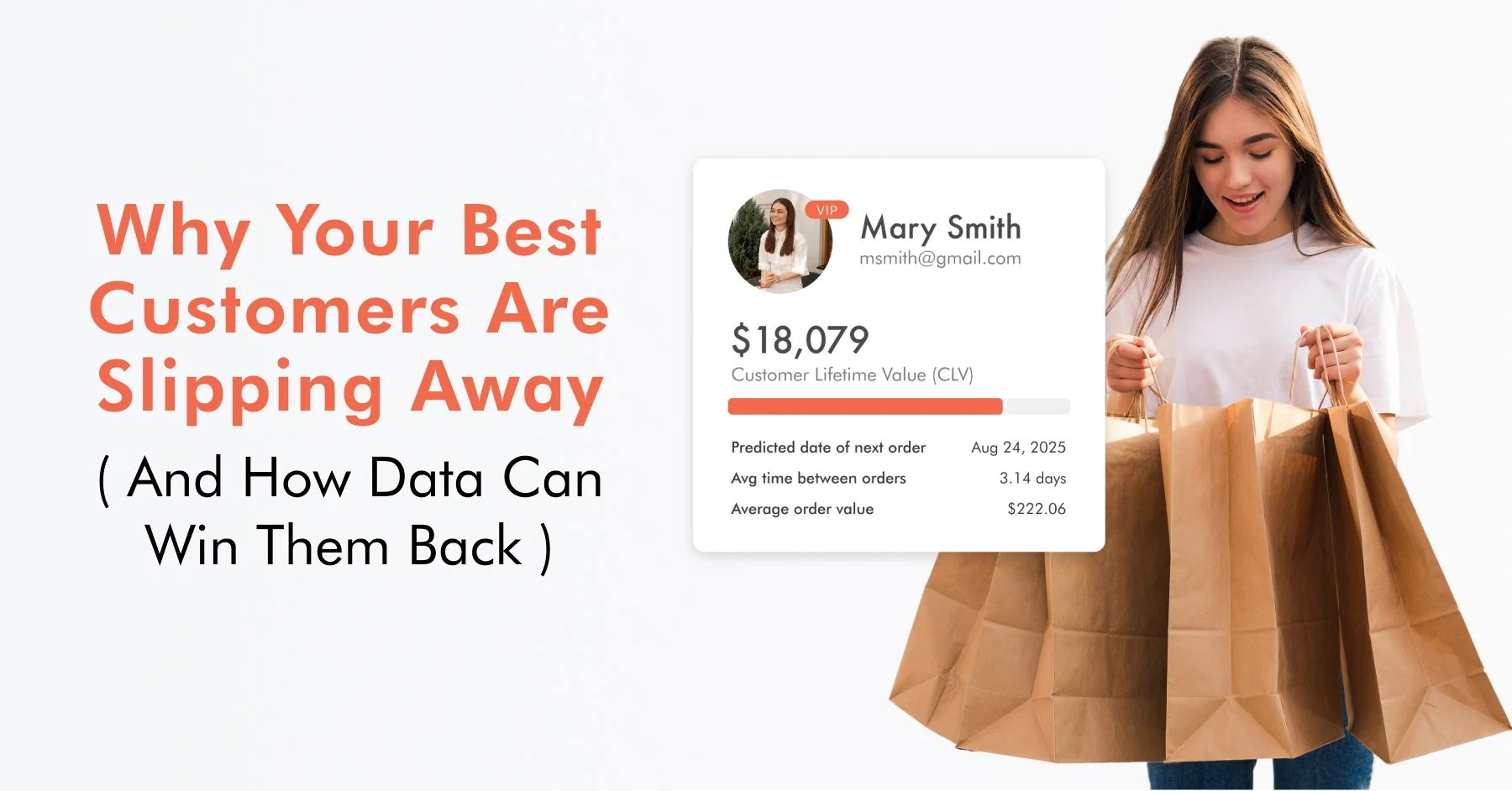

Your customers are telegraphing their next move through every interaction: purchase patterns, engagement drops, support tickets, and browsing behaviours. The data is already there, sitting in your systems, whispering exactly who's about to churn and why.

The question isn't whether you have enough information to predict and prevent customer loss. It's whether you're going to listen to what it's telling you. Here's how to turn that data into your retention advantage.

What your data is actually saying

A lot of retention strategies fail because they're built on assumptions instead of evidence. You think customers leave because of price, but your data shows they actually churn after three consecutive months of declining engagement. You assume your VIP customers are bulletproof, but behavioural analytics reveal they're often the first to jump ship when they stop receiving personalised experiences.

The key is identifying the patterns that precede churn, not just tracking it after it happens. Purchase frequency dropping by 40%? That's not just a seasonal dip, it's a retention red flag. Support tickets increasing while product usage decreases? Your customer is frustrated and looking for alternatives. These signals exist in your CRM, email metrics, and transaction history right now.

Building an early warning system

Stop waiting for customers to cancel before you act. The most effective retention strategies use predictive analytics to identify at-risk customers weeks or months before they actually leave. This means scoring customers based on engagement patterns, purchase behaviour, and interaction history to create a prioritised list of who needs attention first.

Your customer data platform should flag customers who haven't opened an email in 30 days, made a purchase in 45 days, and whose last support interaction was negative. That's not three separate issues; it's a scream for intervention. When you can predict churn probability with 85% accuracy, you shift from damage control to proactive retention.

Metrics that matter: your retention tracking blueprint

Forget vanity metrics. We’ve already talked about the most important ones for retention in our previous blogs. But these are the data points that predict customer behaviour and directly impact your bottom line:

Purchase frequency decline - Track the gap between purchases. If a customer goes beyond their usual purchase cadence, it’s a strong churn signal. Benchmark your average days between orders and flag profiles who fall outside that window.

Engagement score drops - Monitor email opens, click-through rates, and website visits. A 50% drop in engagement over 30 days is your strongest churn predictor.

Customer Lifetime Value trajectory - Rising CLV indicates loyalty; plateauing or declining CLV signals risk. Track this monthly, not annually.

Support interaction sentiment - Negative support experiences increase churn probability by 60%. Monitor ticket volume, resolution time, and satisfaction scores.

Product usage patterns - For SaaS or subscription businesses, declining feature usage or login frequency often precedes cancellation by 2-3 months.

How to boost customer retention using customer data

Now that you know what to track, here's how to act on it. Effective data-driven retention isn't about sending more emails, but sending the right message to the right customer at the right moment. And you don’t need a loyalty programme to do this.

Segment by risk level. Use your metrics to create three buckets: high-risk (immediate intervention needed), medium-risk (proactive engagement), and stable (maintain current touchpoints). Each group requires different messaging and timing.

Personalise based on behaviour, not demographics. A 25-year-old who buys monthly and a 45-year-old with the same pattern need similar retention strategies. Age doesn't predict churn, but behaviour does.

Automate interventions at critical moments.

Set up two triggered flows based on risk thresholds:

– When a customer reaches high risk, trigger a personalised discount to re-engage.

– When they hit medium risk, send tailored content and incentives to encourage interaction.

Test retention offers systematically. Not every at-risk customer needs a discount. Some need better onboarding, others need product education. Use A/B testing to find what works for different customer segments.

How Klaviyo unifies your customer data for smarter retention

The challenge isn't having the data, it's keeping it all in one place where you can actually use it. Klaviyo's customer data platform connects your e-commerce store, email campaigns, SMS, and customer service interactions into a single customer view.

Instead of guessing why customers leave, you see their complete journey: the email they didn't open, the product they viewed but didn't buy, the support ticket they submitted, and the competitor they researched. This unified view lets you identify patterns across touchpoints and predict behaviour with accuracy that siloed data simply can't match.

Using Klaviyo as your central hub, you can integrate loyalty programs, engagement data, and purchase history into one streamlined strategy. Build segments, personalise rewards, and time campaigns with precision. For more info, take a look at our blog on turning your loyalty programme into an acquisition tool here.

Final Thoughts

Your customer data isn't just numbers on your dashboard. It's the voice of your business telling you exactly what's working and what's broken. Every abandoned cart, every support ticket, every email that goes unopened is feedback you can either act on or ignore.

The companies winning at retention aren't the ones with the flashiest campaigns or the biggest discounts. They're the ones who've figured out how to listen to what their customers are saying through their behaviour. They know that retention isn't about convincing people to stay but about understanding why they'd want to leave and fixing those reasons before they become problems.

Your data has been trying to tell you how to keep your customers happy all along. Stop guessing. Start listening.

If you need any help analysing your customer data, don’t hesitate to reach out. Our boutique team of Klaviyo experts knows exactly which patterns to look for and how to turn those insights into campaigns that actually work.